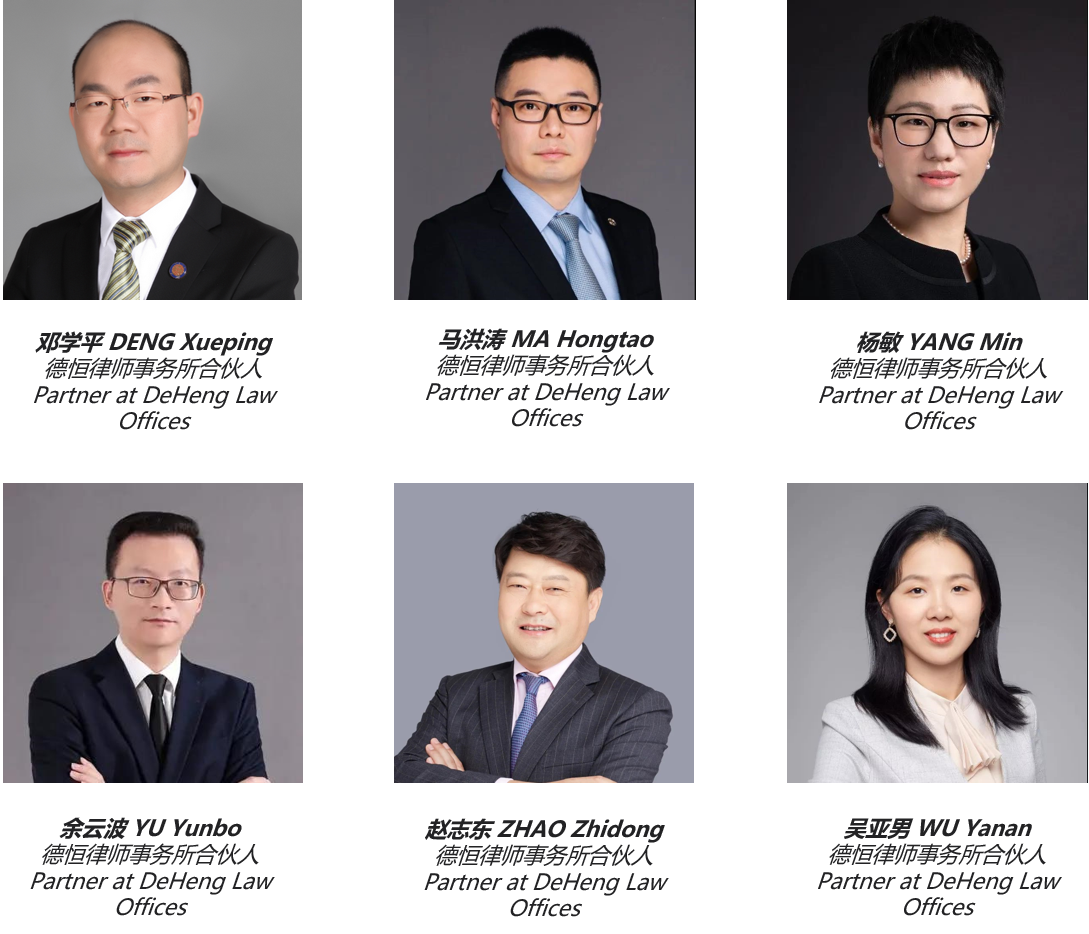

德恒律师事务所上海办公室近期迎来多位律师:邓学平、马洪涛、杨敏、余云波、赵志东和吴亚男以合伙人身份加盟。

邓律师于2014年开始从事律师职业,此前曾担任七年检察官。在加入德恒之前,邓律师执业于上海市锦天城律师事务所。邓律师主要执业领域为刑事辩护、行政诉讼等,曾代理过许多由最高人民法院、高级人民法院审理的重大、疑难刑事诉讼案件。

马律师此前曾执业于京衡律师集团上海事务所,主要执业领域为化妆品、美业、医疗美容和文化等领域的常年法律顾问服务以及相关争议解决业务。马律师曾经在法国工作数年,尤其对法系企业的习惯和文化有深入的理解,在服务国外客户(特别是法国客户)的国际投资、国际贸易以及日常法律事务等方面有丰富的实务经验。

杨律师加入德恒前执业于锦天城律师事务所和北京市隆安律师事务所上海分所。杨律师主要执业领域为私募股权基金、并购和证券业务,具有18年的从业经验,曾长期担任多家私募股权基金的法律顾问,为上市公司与国有企业并购、为企业的股份改制、非公开发行股票、重大资产重组、为境内企业搭建红筹架构及境外上市提供法律服务。

余律师此前曾执业于锦天城律师事务所和北京市中银(上海)律师事务所,其主要执业领域为首次公开发行股票并上市、资产证券化、基金、公司并购等证券与资本市场业务以及财税业务。余律师还曾就职于司法机关多年,之后为京东数字科技控股股份有限公司、新大正等企业提供过法律服务。余云波律师同时持有注册会计师、注册税务师证,擅长综合运用非诉与诉讼方式,为客户提供综合性、创造性的解决方案。

赵律师在加入德恒前执业于北京尚公(上海)律师事务所和锦天城律师事务所,其主要执业领域为私募基金、公司债券、公司收并购、民商事争议解决以及公司重大危机处置等。赵律师具有丰富的诉讼及非诉经验,擅长提出切实可行的解决方案。赵律师服务的客户包括涉外公司、大型国企、985高校、上市公司等。

吴律师曾执业于上海海同律师事务所,其执业领域包括国际/国内船舶买卖/融资、国际和国内仲裁、保险、其他商事和海商海事的诉讼和非诉业务等,其客户主要包括融资租赁公司、保险公司、船东、货代和货主等。

DeHeng welcomes multiple partners in Shanghai

DeHeng Law Offices has recently expanded its team in Shanghai office by adding multiple partners: Deng Xueping, Ma Hongtao, Yang Min, Yu Yunbo, Zhao Zhidong and Wu Yanan.

Before Deng started practicing as a lawyer, he had been a procurator for seven years. Prior to joining DeHeng, Deng practiced in AllBright Law Offices. He has expertise in criminal defense and administrative litigation, having represented many major and complex criminal cases tried by the Supreme People's Court and the Higher People's Court.

Ma practiced in Shanghai office of Capital Equity Legal Group, mainly providing legal advisory services and related dispute resolution services in the fields of cosmetics, beauty industry, medical cosmetology and culture. Ma used to work in France for multiple years, and has in-depth understanding of the corporate operations and cultures of French enterprises. Ma has rich experience in serving foreign, especially French, clients on international investment, international trade and other legal affairs.

Prior to joining DeHeng, Yang practiced in AllBright and the Shanghai office of Beijing Long An Law Firm. Yang’s practice areas include private equity funds, M&A and securities. With 18-years’ experience, Yang has advised a number of listed companies and state-owned enterprises on M&A projects, equity restructuring, private stock issuing, major asset restructuring and foreign listing.

Yu practiced in AllBright and Zhong Yin Law Firm’s Shanghai office before joining DeHeng. His main areas include IPO, asset securitization, funds, M&A, as well as tax business. Yu has also worked in the judiciary for many years, after which he advised enterprises like JD Finance and New Da Zheng Property Group. Yu meanwhile holds the certificates of Certified Public Accountant and Certified Tax Agent.

Prior to joining DeHeng, Zhao worked in S&P Law Firm’s Shanghai office and AllBright, focusing on private equity, corporate bonds, M&A, civil and commercial dispute resolution as well as corporate major crisis treatment. Zhao has rich experience in both litigation and non-litigation business. His clients include foreign companies, large state-owned enterprises, “985 Project” universities and listed companies.

Wu practiced in Hai Tong Lawyer before joining DeHeng. Her practice areas include international/domestic ship trading/financing, international and domestic arbitration, insurance, and other commercial and maritime litigation and non-litigation business. Her clients mainly include financial leasing companies, insurance companies, shipowners, freight forwarders and shippers.

To contact the editorial team, please email ALBEditor@thomsonreuters.com.