面对监管强化和科技冲击,中国充满活力的金融板块在过去一两年中也经历了不断演化。虽然当下情况为金融板块法务带来不小挑战,法务团队也在其中寻找机会,帮助企业“踏浪而行”。

ALB:自2020年下半年起金融监管变化频繁且剧烈,哪些政策新规重塑了您所在行业/机构的业务模式?

“新产品和新业务模式的涌现正不断打破传统认知,知识更迭速度加快,需要我们不断拓展知识领域并融合各方面专业。”

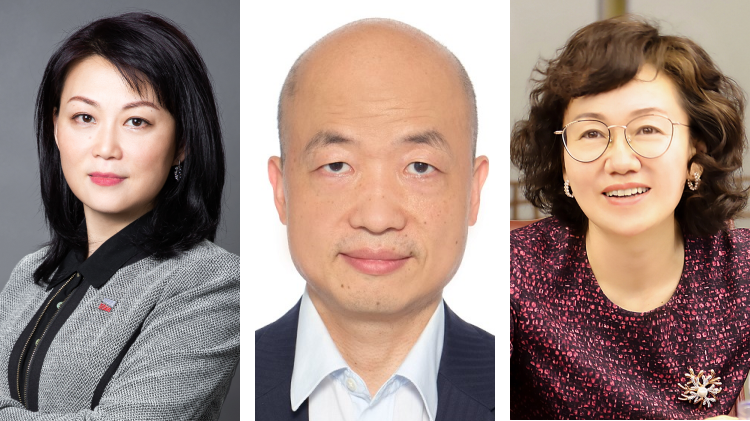

—丁子琴,同方全球人寿保险有限公司

同方全球人寿保险有限公司总法律顾问、首席风控官、首席合规官丁子琴:监管机构主要在互联网、保险资金投资、公司治理方面出台了一系列规定。在互联网方面,发布了《互联网保险业务监管办法》,新规从销售主体资质范围、业务条件、销售管理、服务管理、运营管理等方面对保险公司、持牌保险中介机构开展互联网保险业务提出全面规范性的要求。同时,对于线下业务中移动展业工具的大量使用、营销人员通过自媒体开展营销宣传的情形,在此次新规中要求“线上+线下”相结合的业务模式下,要充分保护消费者合法权益,业务活动需同时满足线上及线下的要求,这也导致了保险公司需要按照业务模式,对内部各业务渠道进行梳理。

在保险资金投资方面,发布了《中国银保监会关于保险资金财务性股权投资有关事项的通知》,加大保险资金对实体经济股权融资支持力度,采纳了“负面清单+正面引导”机制,允许保险机构自主选择投资行业范围。股权投资具有长期性、抗经济周期能力强等特点,与传统投资资产的相关性弱,和保险资金期限长、追求长期收益的特点相一致。从我司的角度,也可以乘坐该新规之风,从战略角度做更多积极的思考,通过一些股权投资来为公司战略目标的达成做更多尝试。

在公司治理方面,2020年下半年,银保监会颁布了《健全银行业保险业公司治理三年行动方案(2020-2022年)》,规划了今后三年健全银行业保险业公司治理的各项重点工作。2021年又先后就银行保险机构公司治理、董事监事履职,以及董监事和高级管理人员任职资格发布了新规。之前行业内很多外资公司,尤其是中外方股东各占一半股权的公司,一些对公司治理的要求如股东会监事会的设置、独董的设置均不再适用,现在新规的要求下纷纷转型,加大对公司治理的投入,使公司发展符合银保监会相应要求。

中国国际金融香港证券有限公司法律合规部董事总经理周佳兴:自2020年下半年起,国内监管机构非常活跃,出台了很多新规和重大政策。

对中金而言影响比较大的,一个是 2020年9月,国务院通过出台《实施金融控股公司准入管理办法》,强化了对金融控股公司的管理;另一个是2021年3月,证监会修订了《证券公司股权管理规定》,从2021年4月18日起,降低对证券公司主要股东的资质要求。此外,证监会在今年3月还出台了《证券公司声誉风险管理指引》,针对部分券商在自媒体上的声誉问题进行更为严厉的监管。

对整个国内金融市场而言,金融监管新规在促进金融市场发展和提升金融市场质量两个维度都产生了令人瞩目的影响。首先,在促进金融市场发展的维度,去年注册制在科创版和创业版的全面实施带来了国内一级市场的繁荣——尤其是股票市场。与此同时,在提升金融市场质量这个维度,证监会不断强调上市公司质量,修改后的《证券法》对于欺诈性披露或者不披露加重了刑事责任。最近上交所也对部分上市申请人展开了现场抽查。此外,针对去年债券市场的风险事件,交易所和证监会对披露也出台了新的规定。在整个金融市场繁荣且有序发展的大背景下,中金一如既往地向市场贡献了大量优质的上市公司,为了配合注册制改革对尽职调查和披露的新要求,中金也相应优化了内部的架构流程。

此外, 放眼海外金融市场,海外监管规则的变化也不容忽略。香港,作为国际金融中心,其金融市场的监管动向非常具有代表性。作为香港金融市场的中流砥柱,香港联交所一直密切关注海内外资本市场的最新变化,不断调整上市要求。最值得一提的,便是有鉴于最近的中概股回归潮,香港联交所于今年3月展开了针对海外发行人上市制度改革的市场咨询,旨在简化海外发行人上市的相关规定,并确保维持股东权利保障的水平;拓宽第二上市制度,欢迎在海外上市而经营传统行业的中国公司来港上市;允许符合条件的发行人在保留现有不同投票权架构及可变利益实体架构的情况之下在香港做双重主要上市。与此同时,香港联交所展开了针对特殊目的收购公司(SPAC)上市制度的研究。另外,对于蓬勃发展的数字经济,香港证监会在2020年颁发了第一个加密货币牌照,开始对交易比特币等电子资产的平台进行监管。

中国投融资担保股份有限公司党委副书记、首席合规官、总法律顾问张晓红:中投保公司是国内第一家全国性专业担保机构,也是中国担保行业的旗舰企业和会长单位,可以说见证并深度参与了中国担保法律体系发展的完整历程。我们的法务团队一直秉持“依法经营、适法发展、用法创新”的理念,多年来持续为公司开拓并引领担保行业发展方向、稳居行业领军地位保驾护航。

《民法典》及配套司法解释的出台对担保制度有较大幅度的修改,许多规则相较《担保法》《物权法》等存在实质性变化,这对我们公司的业务影响深远;新《证券法》生效、注册制的实施、《全国法院审理债券纠纷案件座谈会纪要》的发布以及去年明显增多的债市风险事件与我们公司的债券担保业务密切相关。法律团队着力基础研究,通过梳理公司业务模式和法律问题,检索债券纠纷案件并提炼争议要点,有针对性地提出法律风险防范建议。

为适应法律环境变化,我们提出的风控理念更加突出做稳、做实各项风险控制措施,体现在“实风控、防违约、保抗辩、重程序”四个方面:进一步做实追偿权、反担保以及其他风控措施,确保相关权利的合法性和有效性;提高相对方违约成本,配合加强运营、监控措施;根据风险定价原则,积极争取有利公司的免责条件;重视各债券品种监管规则的差异,预先在项目方案中做好与司法程序衔接的安排。

ALB:在监管变化下,各金融机构也在加紧进行业务及产品创新。您所带领的法务团队支持了哪些新产品/业务模式的开发?有哪些挑战?

丁子琴:首先,市场上高净值客户及财富传承的讨论如火如荼,团队配合公司各销售渠道的需要,对保险+信托合作模式进行研判。目前我国的《信托法》并没有不可撤销人寿保险信托的概念,在设计保险+信托的架构时,主要是依靠合同来约束各方当事人,未来仍需立法机关进一步完善相关立法。从合规角度,过程中最具挑战的是如何充分开展产品宣传,防止出现保险产品与银行、理财类产品产生混淆,以及如何充分保障客户权益,做好保险产品与信托产品的衔接。

此外,依据互联网保险业务新规的要求,团队参与到了传统线下业务渠道互联网保险营销宣传业务模式的开发中,过程中最具挑战性的是如何划分线上与线下业务环节;不能划分时,如何设置管理措施,以满足线上、线下业务的要求。

其次,由于监管拓宽了险资运用场景,公司正在不断探索保险+养老的合作模式,团队积极学习监管文件内容并对保险资金的运用提供及时的风险评估。险资投资养老地产的模式主要有股权投资、物权投资等,根据不同的投资类型有大量的合规性要求需要遵守,并需在相关的合同中予以明确,且该类投资金额大、期限长,除聘请律师做好项目的尽职调查之外,团队还需协助投资部门做好项目监督和投后管理。

总体而言,新产品和新业务模式的涌现正不断打破传统认知,知识更迭速度加快,需要我们不断拓展知识领域并融合各方面专业。

周佳兴:中金一直关注国内社会经济形势和政策的变化,注重业务的自主创新,而非被动地应对监管要求。中金法务团队也一直为中金的业务创新保驾护航。

去年因为疫情影响,部分国内企业陷入经营困难,成了所谓的僵尸企业,但它们又占据了大量的社会资源,包括土地、银行贷款、人力等。为了改善这一困境,中金加强了重组业务,运用法律手段帮助这些公司引进投资者,剥离亏损的业务,将其转变成为具有活力的市场参与者,甚至成为上市公司。其中也涉及到上述公司发行的海外债券的重组。而中金法律部直接积极参与到了这部分业务的开展之中。

从政策这个角度而言,出于促进固定资产投资流动性的需要,吸引更多民间资本、海外资本来投资这一领域,国内进行了公募投资信托基金(REITS)改革,也出台了相关政策。中国的固定资产投资规模是以万亿元为单位来计算的,如果能把这些带来稳定现金流的固定资产转化为REITS,再匹配需要长期稳定回报的资金,就可以形成庞大的市场。中金注意到这个领域巨大的市场潜力,在这方面做了很多准备工作,力求成为市场先驱。

此外,中金也利用自身的独特优势,在产品和服务方面做了很多创新。作为立足中国、放眼世界的国际化一线投资银行,中金在国内和香港都有业务牌照,并且在海外有单独的评级。利用这个优势,中金继续帮助国内和海外的客户进行双向投资,并提供风险管理等服务,开发了大量新产品和服务模式。在此过程中,法务积极参与了相关产品和服务的设计,提示和把控相关产品和服务涉及的法律风险。尤其是新型跨境业务,需要满足国内和海外的双重规定,业务的合法合规至关重要。

除了积极参与公司的各个业务环节,中金法务也参与国内监管机构的监管政策研究。由于中金业务的国际化程度较高,中金法务基于自身在实务过程中积累的经验,协助国内监管机构进行新政策的对比性研究,并从相关海外监管经验的角度对国内政策新规提出建议。

而新规出台后,中金法务会第一时间与前台讨论新规对中金业务的影响。新规定往往有几种情况:一种类型是提供全新的业务机会,比如REITS改革、注册制改革和上市流程、要求的新规,这种类型的新规要求券商重新设计法律文件、内部流程质量控制节点等;另外一种类型则是收紧型的,比如券商的合并风险管理规定。针对新规的颁布实施,法务和风控、合规部门一起制定内部举措,落实监管新规。

总而言之,法务从最早的规则制定阶段和监管部门的沟通,到新规则出台后的落实和遵守,再到具体项目出现问题后的解决,一直都保持了深度参与。

张晓红:2020年公司有两项业务表现突出。一项是“信易佳”电子保函业务,突破性实现在线秒开保函,累计服务企业近6000家,办理电子保函超过27000笔,释放投标保证金占压约人民币61亿元,荣获“2020全国公共资源交易助力复工复产优秀供应商” “2020中国普惠金融助力抗击疫情典型案例”,并入围“互联网+”招标采购全流程电子化交易实践创新成果名单;另一项是同亚洲开发银行合作的“京津冀区域大气污染防治——中投保投融资促进项目”,助力首都及环京区域蓝天保卫战。亚行项目曾作为金融支持绿色的典型入选联合国气候行动峰会优良实践案例,并于2020年获得由国际金融论坛IFF评选的全球绿色金融创新奖。

过去一年,公司法务团队主要面临三方面的挑战:第一是如何应对并解决金融科技相关业务领域新兴法律问题。为此,我们通过外部咨询、专项研究,重点解决了数据合法、智能合规、信息保护、知识产权、电子签章等业务拓展中的难点、痛点,有力支持业务创新。第二是如何克服疫情对公司经营展业的影响。我们密切跟踪新政、新规,及时拟定一系列法律风险提示和工作建议。第三是如何在保持法律审核质量的情况下提高审核效率。法务团队通过建立、完善示范文本库、提炼合同审核要素持续推动合同审核标准化,有效缓解随业务拓展不断增长的法律服务需求与相对固定的法务团队规模之间的矛盾。

“疫情之下‘非接触式’的数字化改革成为金融机构发展不可逆的趋势,但金融科技并没有脱离金融的功能和风险属性,而且一定程度上增加了新的风险因素和风险集聚效应。”

—张晓红,中国投融资担保股份有限公司

ALB:疫情之下数字经济加速发展,金融板块也正在被技术重塑。作为总法,您如何帮助机构平衡金融科技产品与金融安全之间的关系?

丁子琴:数字经济加速发展,无论从立法还是从监管层面,都十分关注金融科技产品和新兴技术带来的风险,尤其是个人信息保护方面的风险。《民法典》已明确了隐私和个人信息的内涵外延、隐私保护的行为规范、信息主体和信息处理者的权利义务、个人信息的侵权责任。正在制定中的《个人信息保护法(草案)》,对企业处理个人信息提出了更具体的要求,大幅度增加了对违法行为的罚款力度。作为总法,需要让公司加大对客户个人信息安全的重视力度,对此,需要跟业务渠道及后援部门充分沟通,在相应的销售场景以及运营单证上增加相应的内容,确保客户信息收集的合法性,维护消费者权益。

此外,总法也要提醒公司IT提升技术层面的安全防护措施,如信息储存、使用、内部管理,并强化提升人员意识。如在信息存储方面,对于敏感数据可进行脱敏、掩码等处理;数据储存和访问权限应当进行隔离;对开发、数据操作员、系统使用者角色分离设置;完善信息修改、拷贝、下载、传递的内部审批流程等。

周佳兴:新冠疫情大大加速了数字化的进程。中金不仅强调具体技术手段的应用,更加强调观念甚至战略层面的数字化思维。中金今年的三个战略之一就是数字化,希望朝着“数字银行”的方向取得长足进步。

金融的本质很简单:把资金的供应方和需求方通过高效的方式联系起来,而中金要解决的问题就是如何让技术为这一金融过程赋能。

从中金自身业务层面而言,首先,中金成立了很多的敏捷小组(agile group)来解决业务痛点。由于这些小组具有相应授权,可以非常敏捷地提供解决方案,并后续不断修正迭代。目前,敏捷小组成员主要是前台业务人员,包括销售人员和IT人员,例如编程专家和数据专家。后续部分敏捷小组还将纳入法务部人员。其次,中金也在具体的业务开展过程中采用了大量的新技术,例如虚拟电话和云主机,使得用户可以使用手机或笔记本电脑完成全部交易流程。此外我们也在密切跟踪区块链技术的发展。区块链的使用对于KYC合规以及代币化证券的交易大有裨益,也可以大大压缩交易时间和成本,实现交易7天24小时高效运作。这是帮助金融企业更好地实现自身功能的一个很重要的方式。

从中金的投资策略层面,中金旗下的中金资本投资了大量金融科技企业,其中相当一部分成为了上市公司,有效实现了中金的投资回报。同时,我们非常留意这些企业研发的技术产品,未来也会应用到中金的业务过程之中。

在中金数字化的进程中,法务未来会更加深度地参与,跟上业务和产品创新的步伐,更好地为达到数字化这个战略目标服务。

张晓红:疫情之下“非接触式”的数字化改革成为金融机构发展不可逆的趋势,但金融科技并没有脱离金融的功能和风险属性,而且一定程度上增加了新的风险因素和风险集聚效应。因此,我要求团队必须要提高政治领悟力、把握监管趋势、坚守合规底线。具体而言,要处理好两个方面的关系:一是处理好发展和风控的关系。维护金融安全是金融从业机构和从业者的责任,要把握好节奏和力度,把安全放在更加重要的位置上,在做好全面风险管理的前提下,审慎推进金融科技创新。二是处理好事前防范、事中控制与事后补救的关系。好的风控一定要有前瞻性,立足前端即介入,防患于未然。比如,对于小额分散的线上业务,应在合同中事先设置有利于催收的送达条款和相对便捷的争议解决方式。

ALB:过去一年中您所带领团队是否应用了新的技术工具,升级法务工作效率及团队运营方式?

丁子琴:2020年公司完成了反洗钱风控系统的迭代,极大改善了法务团队工作效率。新系统对所使用的上游数据进行了梳理和统一,并通过以往工作中积累的人工识别经验与实际案例,设置了风险监控预警规则,通过数据分析最终形成风险监测结果,极大减轻了人力资源的投入。外来,希望随着业务规模的发展、系统覆盖到更为大量的客户样本后,能够引进更先进的机器学习、关联图谱技术等,或能够实现基于区块链技术构建的行业客户身份信息库等,以进一步提升工作效率。

此外,过去一年我们将合同管理模块嵌入了公司线上统一协同办公平台,实现线上全流程管理,提高了公司整体的合同审核效率。

在过去一年中,法务团队通过微信移动平台、H5页面、短视频、宣传彩页、海报等新媒体技术手段开展宣传培训,同时利用电子投票平台,发起合规宣传小视频点赞评选活动,以激发全体员工参与法律合规宣传的积极性。

周佳兴:中金法务团队从一开始就意识到了法律科技应用的重要性。去年,我们签约引进了iManage系统,这是一个文档、电邮管理系统,能够给法务工作提供很大便利。此外,受到远程/在家办公的影响,法务团队也采用了前述的虚拟电话、云主机等技术。为满足监管提出的全流程留痕要求,我们采用了企业微信进行内部沟通。最近,我们和普华永道进行协商,了解它开发的法律科技平台NewLaw(新法),选取该平台上适合中金法务团队的功能。

下一步我们首先会对人工智能合同审阅工具进行考察,了解现有技术处理标准和非标准业务的能力。其次,我们考虑将合同管理和中金内部的负面舆情监控系统连接起来,起到随时监控的作用。最后,有些大型律所或者数据公司正在研发判决分析类系统。法务遇到案件时,可以将信息输入系统,通过人工智能比对,找出相关判例,这将大大便利法务的日常工作。我们也在留意这方面的进展。

“我们正计划成立一个法律运营小组。小组里会引进有数据专家,帮助我们对合同进行智能化管理和持续性监控。”

—周佳兴,中国国际金融香港证券有限公司

此外,我们正计划成立一个法律运营小组。法务团队目前积累了大量信息,但并没有收集这些信息,例如,中金每年聘用的外部律师费的数额以及中金客户支付的律师费的数额等。未来我们会利用技术工具开始收集这些信息,并建立系统,以便监控法律费用的支出情况。为了推进对新技术工具的使用甚至普及,法律运营小组里会引进有数据专家,帮助我们对合同进行智能化管理和持续性监控。

张晓红:新技术应用方面,中投保公司也走在担保行业的前列:首先,我们有自己的技术团队,线上业务基本实现电子签署,充分利用数字签名和电子签章技术确保合同签署环节的安全性和有效性;其次,我们不断推进完善公司内部合同管理制度和管理方式,通过信息手段优化并固化合同报审流程和报审形式,借助信息化工具提高合同审核效率;再次,借助外部信息咨询和检索工具来提升工作效率和品质,及时向公司全员分享法律资讯动态;最后也是比较重要的一点,公司一贯重视风控领域信息化基础设施建设,目前已着手搭建适应线上业务发展需要的综合管理平台、符合风险管理要求的数据处理和风控系统,从而促进风险防范技术转型升级,培养具有我司特点的核心风控能力。

ALB:未来一年中您将重点关注的领域有哪些?您将如何根据这些关注点打造一支更好的团队?

丁子琴:未来一年重点关注的继续是公司治理、反洗钱、关联交易、网络安全等内容,这些板块需要团队更加具备前瞻性能力,除了具有专业只是,也要能够融合多方面知识,并能够利用科技手段附能本职工作。

周佳兴:2021年中金发展的重点之一是国际化。在当前的国际政治背景下,中国企业走向世界具有相当的敏感性,也面临一定的风险,因此,在中金发展业务的同时又控制风险,是我们今年工作的重中之重。在中金的高速国际化进程中,建立与之相匹配的内部法务团队架构,并且配备合适的团队成员,对其进行文化等方面的培训,帮助总部管控各地风险,这是迫在眉睫的挑战。法务团队自身的能力建设不仅包括增强技术手段,更在于拥有优秀的人才。招聘既能和公司文化契合,又有良好的专业背景和能力的人才也是一个挑战。

张晓红:作为中国担保业的旗舰企业,公司确立了以担保增信为主、资管投资和金融科技为两翼的“一体两翼”业务架构。具体在担保主责主业方面,未来一年公司关注四个方向:聚焦以公开市场债券为主的直接融资市场,进一步增强公司在信用增进领域的市场地位;利用科技手段推动中小微融资担保业务模式的建立和优化,树立行业品牌;继续加强非融资性担保业务开拓,提高市场占有率;继续巩固同亚洲开发银行的合作,进一步提升公司在绿色金融领域影响力。

国家经济环境和担保行业环境在不断变化,公司在不同发展阶段也有不同的战略目标和策略选择,但对于总法而言,我认为有些法律工作方法和工作思路历久弥新,我把它们总结为“法”“术”“势”三个方面。“法”是说核心能力上,我们要不断磨练法律看家本领,紧跟立法动态,加强深度研究,转化研究成果,支持创新发展;“术”是指工作技术层面,我们持之以恒的完善标准化合同文本库、总结风险防范和风险化解经验、优化法律事务工作管理机制、通过举办全员合规手册宣誓、签署合规承诺书等形式强化合规文化建设;“势”则是指所有的法律工作要服务于大势:也就是赋能公司战略,积极贡献法治价值。我引导我的团队从这三个方面去审视自己的工作目标和工作绩效。

归根到底,工作方法只是工具,我关注的核心终究仍是掌握这些“工具”的人。我认为一个优秀的团队应该是一群热爱并敬畏法律的专业人士组成的集合,以研究和解决法律问题、帮助公司化解法律风险为己任。我很荣幸,经过二十多年的传承和积淀,我们拥有这样一支专业过硬、能打能拼的团队,我想这和三个因素息息相关:一是我们一边使用人,一边培养人,重视人才储备,强调在职培养;二是我们既要理解人、又要尊重人,营造了团结友爱、积极向上的工作氛围;三是我们不但包容人、而且激励人,从而以实现与公司共同成长为目标,塑造了一支自我驱动型团队。

GC Roundtable: Banking & Finance

China’s dynamic finance industry has been evolving rapidly in the past year or two in the face of increasing regulatory scrutiny as well as the growing impact of technology. Legal department heads say that while the current landscape poses certain challenges, it also brings with it a number of distinct opportunities that in-house teams are helping their companies take advantage of.

ALB: The financial markets have seen frequent and significant policy and regulatory changes since the second half of 2020. What are some of the newly enacted policies and regulations that have reshaped the business model of your company, as well as the industry generally?

“The emerging new products and new business models are breaking away the traditional perception, and the accelerating pace of change in knowledge is driving us to constantly broaden the sphere of our expertise and learn extensively from other professions.”

—Ashley Ding, Aegon THTF Life Insurance

Ashley Ding, general counsel, Aegon THTF Life Insurance: The numerous regulations issued by regulatory authorities mainly apply to Internet business, investment with insurance funds, and corporate governance. In terms of Internet business, the Measures for the Regulation of Internet Insurance Business sets out sweeping normative requirements for insurance companies and licensed insurance intermediaries in their Internet-based insurance underwriting business, prompting us to examine all internal business channels against our business models.

With respect to investment with insurance funds, the Notice of the China Banking and Insurance Regulatory Commission on Matters Concerning Financial Equity Investment with Insurance Funds allows an insurance institution the discretion to choose the industry sectors in which it employs insurance funds. As far as Aegon THFT is concerned, I believe we can take advantage of this new regulation and have more strategically positive thinking to further explore the use of equity investment to achieve our strategic objectives.

Finally, as to corporate governance, in the second half of 2020, the CBIRC clarified the corporate governance priorities of the banking and insurance industries in the next three years, which was followed up by new rules governing corporate governance, the performance of duties by directors and supervisors, etc. in such institutions in 2021. Many foreign-funded companies in the industry, particularly those where the Chinese and foreign shareholders each have a 50% equity stake, have started to ramp up corporate governance efforts as required under the new rules.

Joe Zhou, managing director and head of the legal department of legal and compliance, China International Finance Corporation Hong Kong Securities Limited (CICC): Chinese regulatory authorities have been very busy since the second half of 2020, promulgating an array of new rules and important policies. Two of them have significant impact on CICC: the first is the more stringent management introduced by the State Council in relation to financial holding companies; the second is the revision by the CSRC to the Administrative Provisions on the Equity of Securities Companies in March 2021, which loosened the eligibility requirements on major shareholders of securities companies. Further, the CSRC also tightened regulation in light of the reputation incidents of some securities brokers on self-media.

Looking at the domestic financial market as a whole, the full-scale roll-out of a registration-based IPO system on the ChiNext market and STAR market in 2020 brought life to the primary market, particularly the stock market. Meanwhile, the CSRC made repeated calls for improving the quality of listed companies for purpose of raising the quality of the financial market. Further, the exchanges and the CSRC issued new disclosure rules in response to the risk incidents on the bond market last year. To comply with the new requirements on due diligence and information disclosure as part of the registration-based IPO reform initiative, CICC has optimized its internal structure and procedures.

Changes in overseas regulatory rules should not be overlooked. Hong Kong, as an international financial center, is very representative when it comes to regulatory trends on its financial market. As an increasing number of US-listed Chinese companies head home to relist, Hong Kong Stock Exchange (HKEX) published a consultation paper this March seeking views on reforms to the listing regime for overseas issuers. At the same time, the HKEX studied a listing regime for special purpose acquisition companies (SPACs). In addition, with the digital economy thriving, Hong Kong’s Securities and Futures Commission (SFC) granted its first license to a crypto trading platform in 2020, the first step to regulate platforms that trade bitcoins and other virtual assets.

Zhang Xiaohong, general counsel, China National Investment and Guaranty Corporation: China National Investment and Guaranty Corporation, as China’s first national guaranty agency, has witnessed and been deeply involved in the evolution of how China’s legal system for guaranty. The Civil Code and its supporting judicial interpretations enacted in the past year have made substantial amendments to China’s existing guaranty regime, and many new regulations are substantively different from the annulled Guaranty Law and the Property Right Law, posing a profound impact on our business. Developments in the past year that are closely related to our bond guaranty business include the implementation of the revised Securities Law, the roll-out of the registration-based IPO reform, the promulgation of the Minutes of the National Courts Symposium on the Trial of Bond Disputes, as well as a notable increase of risk incidents in the bond market. Our in-house team focused efforts on basic research, searched for bond dispute cases and distilled key disputes by looking at our business model and legal issues, and proposes pertinent solutions to prevent legal risks on this ground.

ALB: Financial institutions are quickening their pace of product and business innovation in response to regulatory changes. What innovative products or business models have your team supported recently and what challenges have you faced?

Ding: First, as the market is having heated discussions on high-net-worth individuals and wealth inheritance, our in-house team worked with sales department to evaluate the insurance + trust business model. From a compliance perspective, the biggest challenge was how to effectively promote a product to avoid causing confusion between an insurance product and a banking or wealth management product, and how to fully protect the rights and benefits of clients and properly integrate insurance and trust features in one product.

In addition, in light of the new regulations on Internet insurance business activities, the in-house team got involved in designing a new business model that enables the use of traditional offline channels to market and promote Internet insurance businesses. The biggest challenges there were how to differentiate online processes from offline ones; and if such differentiation is impossible, how to put in place management measures to meet the requirements of both online and offline business activities.

Secondly, as regulatory authorities have broadened the scope of industries in which insurance funds may invest, we have been constantly exploring opportunities for the insurance + pension business model. If we are to invest insurance funds in elderly care housing projects, we will be subject to extensive compliance requirements, which must be set out in relevant contracts. The in-house team also needs to assist the investment department in project oversight and post-investment management.

To conclude, the emerging new products and new business models are breaking away the traditional perception, and the accelerating pace of change in knowledge is driving us to constantly broaden the sphere of our expertise and learn extensively from other professions.

Zhou: In CICC, the in-house team has always been bolstering business innovations. In 2020, due to the COVID-19 pandemic, some domestic companies were faced with operational challenges and became so-called zombie companies. Against this backdrop, CICC stepped-up corporate reorganization services, which involved the restructuring of the bonds issued by such companies overseas. The in-house team was directly and actively involved in such business activities.

China also kicked off reforms on real estate investment trusts (REITS) in the past year and published new policies in this area. CICC, having a sense of the massive potential in this field, has made a lot of preparation, aiming to become a forerunner in this market segment.

CICC has also attempted many innovations in products and services by taking advantage of its unique strength. The in-house team was actively involved in the design of such new products and services, issuing reminders of and controlling potential legal risks associated with such products and services. In particular, as both domestic and overseas regulations must be followed when it comes to novel cross-border business activities, legal and regulatory compliance is of paramount importance.

In addition to active involvement in all business stages, the in-house team also took part in regulatory and policy research initiated by domestic regulatory authorities. After new regulations are promulgated, the team will, as soon as practical, discuss with the front office the impact of such regulations on CICC's business.

Zhang: Over the past year, our in-house team faced three major challenges. The first was how to deal with and resolve emerging legal issues in fintech-related business areas. To that end, by consulting external professionals and carrying out thematic studies, the team managed to resolve the pain points and difficulties in the areas of data compliance, AI-based compliance, information protection, intellectual property rights and e-signature, providing strong support for business innovation. The second was how to lessen the COVID-19 disruption to business operations. The third was how to raise the efficiency of legal review without compromising quality. To address this concern, our team made constant efforts to standardize contract review procedures, including by establishing and updating the template library and identifying essential elements of contract review, effectively alleviating conflicts between the growing demand for legal services as a result of business expansion and the limited size of the in-house team.

ALB: COVID-19 has accelerated the rise of the digital economy, and technologies are reshaping the financial sector. As general counsel, how do you help the business strike a balance between digital innovation and financial security?

Ding: Given the fast-accelerating digital economy, both the legislature and regulatory authorities are paying close attention to risks arising from fintech products and emerging technologies, particularly risks related to personal information protection. A general counsel needs to ensure everyone in the company attach greater importance to the security of clients’ personal information. This means I must fully communicate with business functions and back-office functions, and add relevant contents in sales scenarios and business documents so that clients' information is gathered pursuant to the law and the rights and benefits of consumers are protected. As general counsel, I also have to remind the IT department to implement enhanced safety and security measures.

Zhou: The COVID-19 pandemic greatly quickened the pace of digitalization. CICC not only focuses on the adoption of technological means, but also places more emphasis on having a digital mindset or even strategic perspectives. With digitalization being one of its strategic focuses in 2021, CICC aims to make considerable headway towards “digital banking”. In essence, finance is simply about efficiently bridging the supply and demand of funds, and what CICC needs to resolve is how to use technology to make this happen.

On the business front, CICC has set up a number of agile groups to fix pain points in business operations. As these groups possess the corresponding authority, they can be agile in providing solutions and revising or iterating such solutions subsequently. So far, agile group members are mainly from front-office functions, including sales functions and IT staff such as programming experts and data experts. We plan to include legal staff in the agile groups going forward.

In terms of investment strategies, China Capital Investment Group, a subsidiary of CICC, has invested heavily in fintech firms, and some of them are now listed, realizing investment returns for CICC. Besides, CICC keeps a close eye on the technology products developed by such firms, with a view to adopting them in future business processes.

The in-house team will get more involved in CICC’s digitalization journey and stay abreast of the latest developments in business and product innovations, to better serve the strategic objective of digital transformation.

“During the pandemic, contactless digital reform has become an irreversible trend for financial institutions. However, fintech products maintain features and risks that are peculiar to the finance sector, and to some extent, include new risks and demonstrate clustering effects of risk behaviors.”

—Zhang Xiaohong, China National Investment and Guaranty Corporation

Zhang: During the pandemic, contactless digital reform has become an irreversible trend for financial institutions. However, fintech products maintain features and risks that are peculiar to the finance sector, and to some extent, include new risks and demonstrate clustering effects of risk behaviours. Against this backdrop, I asked my team to stay on top of regulatory developments and stick to the bottom line of compliance.

To be specific, this means we must strike the right balance between business growth and risk management, and between ex-ante risk prevention, interim risk control and ex-post remedy. As to the former, financial institutions and practitioners bear the responsibility of maintaining financial security, and they should push ahead with fintech innovation prudently under the premise of comprehensive and effective risk management. For the latter point, an effective risk management framework must be forward-looking. Take petty-sum and scattered online transactions as an example. The contracts should include a service clause that facilitates payment collection and a clause that provides convenient dispute resolution methods.

ALB: Over the past year, has your team adopted new technology tools to increase productivity and update the team's operations?

Ding: In 2020, the completion of the iteration of the company's anti-money laundering risk control system greatly improved the productivity of the in-house team. The team also embedded a contract management module into the integrated online co-working platform in 2020, thus achieving full process management online and raising contract review efficiency at the company level.

In the past year, we also launched promotional events and training courses by using new media tools such as WeChat mobile platform, H5 pages, short videos, promotional flyers and posters, mobilizing all staff to get involved in compliance promotion campaigns.

Zhou: CICC's in-house team started using the iManage system last year. Given remote working/working-from-home arrangements, the team also adopted virtual phone and cloud hosting tools. We started using the corporate WeChat platform for internal communication to meet regulatory requirements on whole process traceability. Recently we have spoken with PwC to understand NewLaw, a legal technology platform it developed, and will select features on the platform that are suitable for our in-house team.

For the next steps, we will examine AI-based contract review tools. Then we will consider connecting contract management to CICC’s in-house unfavourable views monitoring system. Finally, some large law firms or data companies are developing judgment analysis systems. In such a system, when encountering a case, an in-house counsel may enter the relevant information into such a system and retrieve relevant precedents by using AI-enabled comparison, thus greatly benefiting the in-house teams in their daily work.

“We are planning to establish a legal operations team. To promote and even popularize the use of new technology tools, the team will have data experts to help us with AI-based management and constant monitoring of contracts.”

—Joe Zhou, China International Finance Corporation Hong Kong Securities

In addition, we are planning to establish a legal operations team. The in-house team has so far collected a massive volume of information. Going forward, we intend to use technology tools to collect such information and set up a system to monitor legal costs. To promote and even popularize the use of new technology tools, the legal operations team will have data experts to help us with AI-based management and constant monitoring of contracts.

Zhang: China National Investment and Guaranty Corporation leads the guaranty industry in terms of new technology adoption. Firstly, with an in-house technology team, we have established a mechanism for most online transactions to be signed off electronically, making full use of the digital signature and electronic seal technology to ensure security and validity in contract signing procedures. Secondly, we are increasingly leveraging IT means to optimize and nail down contract review procedures and formalities and using IT tools to increase productivity in contract review. Also, the team relies on external information consulting and search tools to improve work efficiency and quality, so that it could share the latest legal news and developments with all staff. Lastly, the company has started to build an integrated management platform to accommodate online business activities, and a data processing and risk control system that meets risk management requirements.

ALB: Where are some of your focus areas in2021? How do you plan to build an even better team centering around these focus areas?

Ding: I will continue to focus on corporate governance, anti-money laundering, related-party transactions and cybersecurity in 2021. These areas require the team to be more forward-looking. Apart from legal expertise, the team must have knowledge of many other different fields and be capable of employing technologies to better perform their fundamental duties.

Zhou: Going global is on CICC’s top agenda for 2021. Given the current international political landscape, Chinese enterprises going global would rattle the nerves of many. Thus, the top priority for the in-house team is to control risks while CICC grows its business. It is a pressing challenge to structure an in-house team that fits CICC’s quick pace of internalization, to equip the team with the right talents and to train them on corporate culture, so that the in-house team can help the headquarters manage risks associated with its subsidiaries in various regions. Capability building of the in-house team involves not only extensive application of technologies, but more importantly, the acquisition of exceptional talents. It is also a challenge to recruit talents who not only identify with CICC's corporate culture but also have strong professional backgrounds and capabilities.

Zhang: National economic situations and the guaranty industry landscape are changing constantly. The company likewise has different strategic goals and makes different strategic choices in different stages of development. However, as general counsel, I believe the following ways and thoughts of legal work stand the test of time: to keep sharpening legal skills, stay abreast of legislative updates and ramp up extensive legal research; to persevere in reinforcing the compliance culture; and, to perform legal duties to empower corporate strategies and actively contribute to the rule of law. I will guide my team members to review their departmental objectives and performance from these three perspectives.

After all, ways of working are merely tools. The area of my focus will always be on the people that use such tools. I believe a great in-house team should consist of professionals who are both passionate and humble about the law, and who have a sense of mission to study and resolve legal issues and help the company mitigate legal risks.

To contact the editorial team, please email ALBEditor@thomsonreuters.com.