近日,中国恒大新能源汽车集团有限公司( “恒大汽车”)宣布其拟从美国纳斯达克上市公司纽顿集团引入5亿美元战略投资。方达律师事务所担任纽顿集团的中国内地和香港特区法律顾问,贝克·麦坚时律师事务所则为恒大汽车提供法律咨询。

据悉,该交易是恒大集团整体重组的一部分。投资后,纽曼集团将获得恒大汽车27.5%的股份,并将取代恒大集团,取得恒大汽车的经营管理权并控制其董事会。

此外,纽顿集团将为恒大汽车的复工复产提供大额过渡期资金支持,还将协助恒大汽车开拓海外市场,实现年均向中东市场出口3万至5万辆的目标。

今年,恒大汽车曾做出一系列举动,“包括产业园板块的重组、在香港联交所的复牌以及最近的战略投资,我们非常荣幸能够在恒大汽车发展中的每一步都发挥了作用”,贝克·麦坚时资本市场合伙人李心雯律师说。

纽顿集团是一家领先的绿色能源公司,总部位于阿联酋迪拜,致力于为全球客户提供以乘客为中心的优质电动汽车产品和绿色能源解决方案。

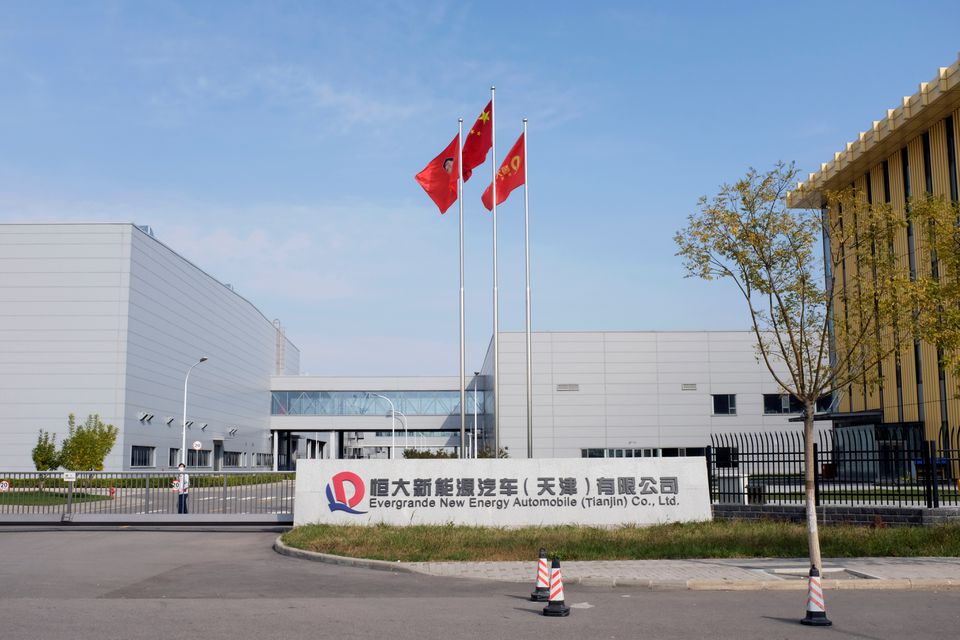

根据界面新闻,纽顿集团于2022年通过SPAC方式登陆纳斯达克,是阿联酋新能源在美国上市的第一家企业。该公司与中国有着诸多联系:其前身是位于天津的造车新势力艾康尼克(ICONIQ),公司CEO等部分高管也为中国人。目前公司由阿联酋皇家集团控股。

贝克·麦坚时团队牵头律师为资本市场合伙人李心雯,团队还包括资本市场团队合伙人李金鸿、合伙人黄敬德,以及银行与金融团队合伙人梁世杰。

方达大湾区深圳、香港、广州办公室以及北京办公室则在本次交易中紧密合作,由香港资本市场组合伙人罗德源、公司业务组合伙人蔡明卉和李祥、银行组合伙人卓海、争议解决组合伙人苏毅,以及反垄断组合伙人王瑾带领。

Fangda, Baker assist Evergrande NEV in securing $500 mln strategic investment

China Evergrande New Energy Vehicle Group (NEV) has announced its plan to secure a $500 million strategic investment from Dubai-based mobility firm NWTN. Fangda Partners acted as legal counsel for NWTN in Mainland China and Hong Kong SAR, while Baker McKenzie provided legal advice to Evergrande NEV.

This transaction is part of Evergrande Group's overall restructuring. Following the investment, NWTN will acquire a 27.5 percent stake in Evergrande NEV, replacing Evergrande Group to gain control of its board.

In addition, NWTN will provide substantial funds to support Evergrande NEV's resumption of production and will assist in expanding its presence in overseas markets. The goal is to achieve an annual export target of 30,000 to 50,000 vehicles to the Middle East market.

Throughout this year, Evergrande NEV has made a series of moves, including restructuring its industrial park sector, resumption of trading on the Hong Kong Stock Exchange, and this recent strategic investment. "We are honored to have played a role in every step of Evergrande NEV's development," says Christina Lee, capital markets partner at Baker McKenzie.

NWTN is a leading green energy company headquartered in Dubai, UAE. According to a local news agency in China, the company landed on NASDAQ in 2022 through a SPAC merger, becoming the first UAE-based green energy company listed in the U.S. The company has various connections with China though, as its predecessor, ICONIQ, was an EV car-making force located in Tianjin, and some of its senior executives are Chinese. The company is currently under the control of the UAE Royal Group.

The Baker team was led by Christina Lee, and the team also includes capital markets partner Lawrence Lee, Brian Wong, and banking and finance partner Simon Leung.

Fangda's Greater Bay Area offices in Shenzhen, Hong Kong, Guangzhou, and also its Beijing office worked closely together in this transaction, led by Hong Kong capital markets partner Colin Law, corporate partner Sufina Cai, Patrick Li, banking partner Romy Zhuo, dispute resolution partner Su Yi, and antitrust partner Wang Jin.