基于对美国法律市场不同规模律所的调研,汤森路透近日发布了2022年《法律市场状况报告》。报告表明,2021年法律市场经历进一步复苏,但人才留用、实现更有效率的律所运营等对下一步发展提出了挑战。

财务表现

报告指出,2021年的法律服务需求量出现飙升,截至2021年11月,法律服务需求量同比提升4%,不过和2019年相比,仅提升了1%。

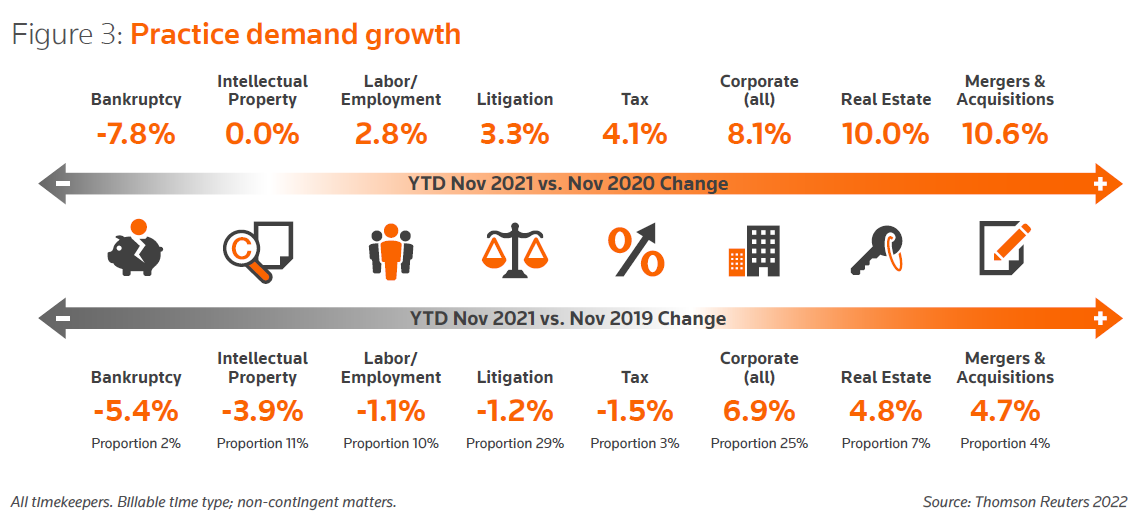

需求量增长最高的业务领域为公司、并购、房地产;诉讼需求则低于疫情前水平。

为提升利润,律所继续抬高费率,加之较高的实现率(realization rates,美国律师的年产值计算方法为:收费时间 X 费率 X 实现率),确保许多律所实现了高额利润。

2021年,美国律师的平均费率增长为3.9%。

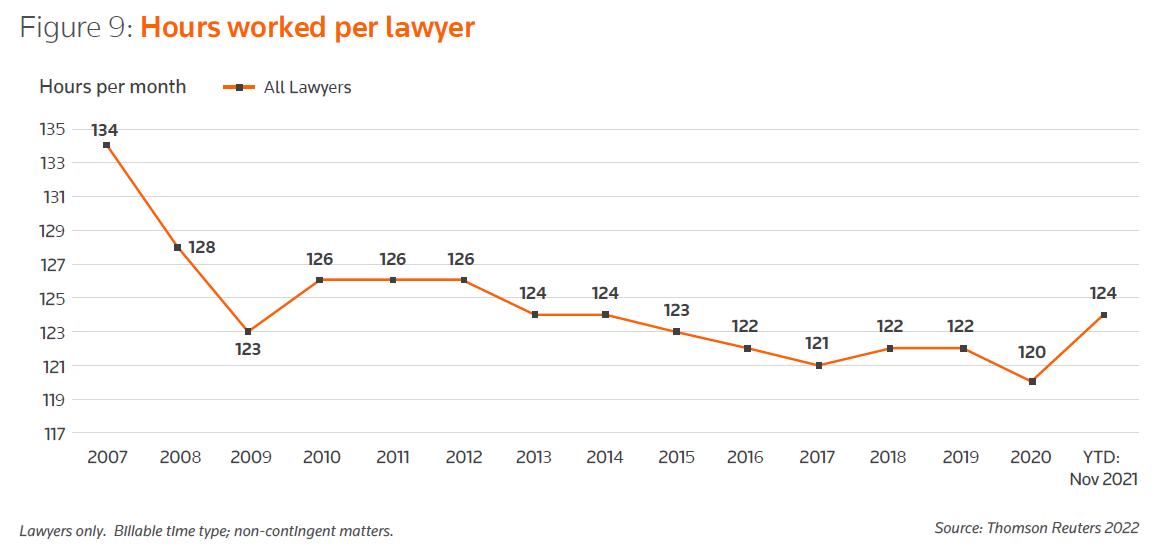

与此同时,律所生产率和疫情前的2019年相比只提到了0.3%。2021年每位律师每月的平均计费小时为124小时,依旧远低于经济危机前、2007年的134小时。

在支出方面,2021年律所的直接和间接费用都出现了明显增长:其中直接费用增长了8.8%,间接费用增长了5.1%。

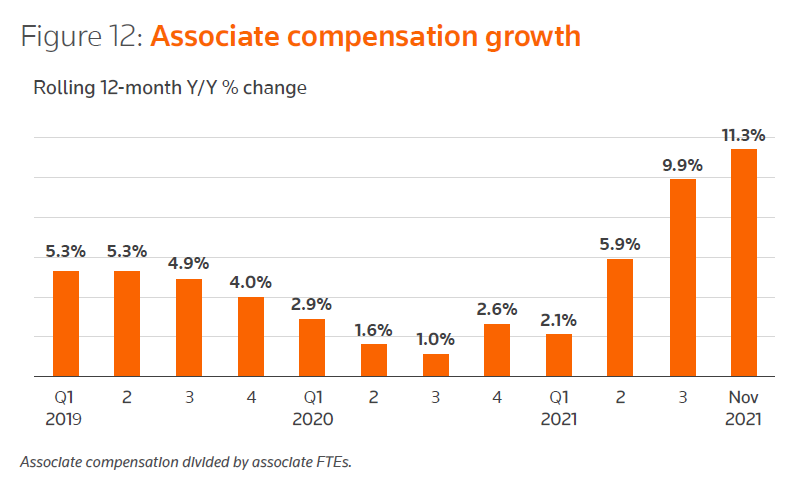

直接费用的增长主要源于普通律师薪资的快速提升:过去一年,美国普通律师平均薪资增长了11.3%,排名前一百位律所(Am Law 100)的平均薪资增长达15%。

此外,律所律师人数也呈现增长:2021年律所平均律师增幅为3.9%,为近十年来最高。

其他引发支出增长的原因包括技术投入、知识管理和法律数据库投入、外包费用以及招聘费用的增长。

四大挑战

基于2021年的情况,报告指出了法律市场2022年面临的四大挑战。

首先是对人才竞争的回应。数据表明,虽然律所普遍通过涨薪争抢人才,但律师流失率也达到新高:2021年这一比例达到了23.2%,意味着到去年年底,律所失去了近四分之一的普通律师。

其次是律所面临着普遍的人才留用危机。除了普通律师,包括市场、行政、人力资源在内的其他专业人员流失也十分严重。

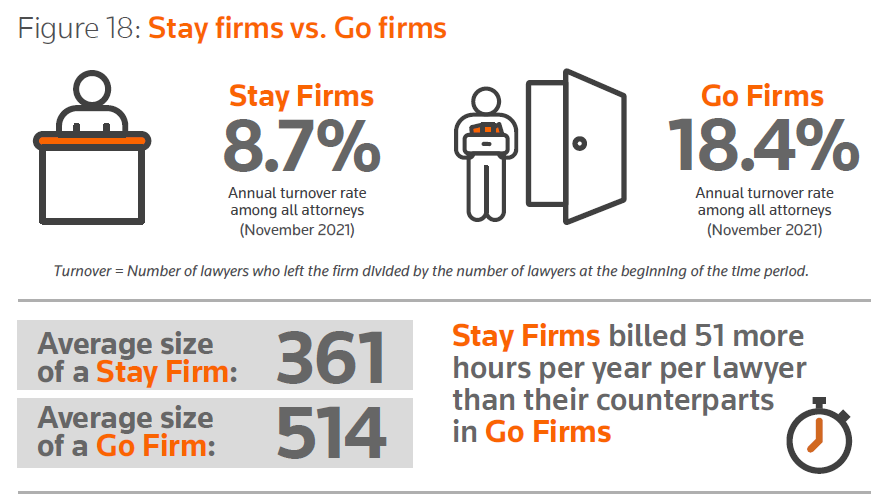

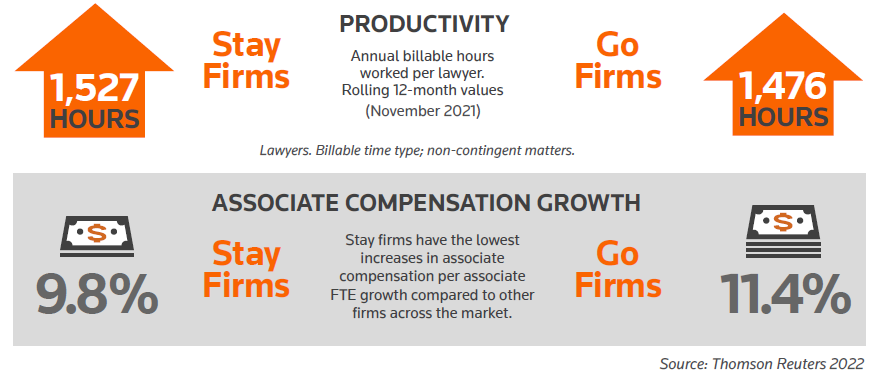

汤森路透在一项尚未发布的调查中,将律所分为了“留人所”和“赶人所”两类。出人意料的是,“留人所”过去一年的涨薪幅度要低于“赶人所”,其律师的年均工时也比“赶人所”多51个小时。这似乎说明,在看得见的指标外,年轻律师也愈发关注“看不见的指标”,例如在工作中得到的赞赏与认可、工作/生活平衡情况等,这些都会决定律师的忠诚。

律所面临的第三大挑战为不断适应多元工作模式。报告指出,目前要求律师一周到岗3天已经成为美国法律界的共识。

最后的挑战则为保持运营灵活性,包括更高效地使用办公空间、灵活调整用工模式、采纳更科学的财务管理措施——包括更严格地管理计费、小时和回款等。

您可点击此处,下载阅读完整报告。

A challenging road to recovery: TR releases the latest report on the state of the legal market

Thomson Reuters has released the 2022 Report on the State of the Legal Market, showing a booming legal market in 2021 yet with challenges in regard to talent retention and efficient management.

FINANCIAL PERFORMANCE

This year’s report shows that demand for legal services soared in 2021, ending up 4 percent compared to 2020, although only up 1 percent compared to 2019. The demand increased especially in the corporate, M&A, and real estate practice areas. Litigation, however, remains below pre-pandemic levels.

To boost profitability, law firms continued to raise their billing rates aggressively last year, which — coupled with rising realization rates — helped to secure another year of strong profits. Through November 2021, worked rates for all timekeepers across all firms grew 3.9 percent.

Meanwhile, productivity improved as compared to 2020, but was only 0.3 percent above the average daily demand per lawyer in 2019. The average billable hours worked per lawyer per month in 2021, which were 124 billable hours, were still substantially below the average hours seen prior to the financial crisis of 2007-‘08, which were 134 hours in 2007.

On the expense side, 2021 saw a sharp increase in direct expenses and overhead expenses: direct expenses rose a whopping 8.8 percent, while overhead expenses grew at 5.1 percent.

The increase in direct expenses reflected primarily the sharp growth in associate compensation across the market. Average associate compensation rose by 11.3 percent. For Am Law 100 firms, the increase averaged over 15 percent.

Furthermore, lawyer headcount growth was up 3.9 percent, the highest level seen in more than a decade.

Other largest increases have been for technology, knowledge management & library services, outside services, and recruiting.

FOUR CHALLENGES

The report then specifies four challenges for the legal market ahead.

The first one is responding to the competition for talent. Statistics show that despite rising compensation, attorney turnover has also risen to record levels. The associate turnover rate for all firms reached 23.2 percent and in stark terms, all law firms were edging dangerously close to losing almost one-quarter of their associates in 2021.

Second challenge is facing the retention crisis. It should be noted that retention issues are not limited to associates but also to professional marketing, administration, and HR staff.

The third challenge is navigating the hybrid work model. The report shows that “there seems to be some emerging consensus that most firms will probably require about three days a week in the office for most lawyers.”

Finally there is remaining operationally flexible. It requires law firm management to adapt to more efficient use of office space, to rethink changes in staffing and work patterns, as well as to stick to sound financial practices, such as rigorously managing timekeeping, billings, and collections.

You can get access to the full report here.