"Made in China" will be a less frequent sight in U.S. clothing stores if the United States has its way in a new trade pact negotiated among 12 Pacific Rim nations.

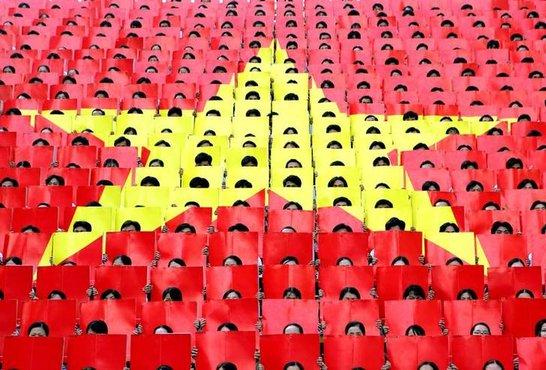

Washington aims to engineer a deal where Vietnam, set to be one of the big winners among the members of the Trans-Pacific Partnership (TPP), would win apparel market share from China and other non-members, rather than Mexico and Central America.

Today, thanks to regional trade deals, half of U.S. yarn and textile exports head south of the border, where cheap labour transforms them into clothes that mostly make it back to American shoppers, duty-free.

Many in the $57 billion (34.63 billion pound) U.S. yarn and textile industry fear the new pact, billed as the world's most ambitious trade agreement, will destroy that business model which has helped the sector rebound from a decade-long slump and sustains more than 1.5 million regional jobs.

A U.S. official who spoke on condition of anonymity said tools such as rules of origin, which say how much local content is required to win duty-free status, and different timetables for tariff cuts could protect regional interests while also providing value for Vietnam.

People in the United States familiar with the negotiations are confident Vietnam could take considerable market share from China and other countries without trade preferences.

"If damage is done to Central America by the TPP, that has a devastating effect on the industry here," says Bill Jasper, chief executive of synthetic yarn maker Unifi.

"If structured properly and intelligently negotiated, I think the majority of the impact is going to be on China and not on this region."

Clothing is a priority for Vietnam, which hosted a round of negotiations on the pact earlier this month, but is just one of the many issues for other countries, which may seek concessions in other areas in return for siding with Washington on textiles.

The other TPP countries are Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru and Singapore.

In practice, different treatment of sectors depending on their U.S. economic impact could mean longer wait for tariff cuts on cotton garments like underwear and men's knit shirts, where Central America has greater market share. Tariffs on products where China dominates, such as down-filled jackets and synthetic dresses, could be cut quickly, giving Vietnam an edge.

Fabrics like silk and herringbone tweed, not mass produced by TPP nations, could bypass rules of origin demanding all clothing inputs from yarn be sourced within the TPP, the U.S. official said, although Vietnam and many U.S. retailers would prefer a much longer list of exemptions.

Vietnam has already boosted its U.S.-bound exports by 38 percent since 2010 even with tariffs adding as much as a third to costs. Peterson Institute for International Economics modeling forecasts a further 46 percent rise in total exports by 2025, with exports from Mexico, China and India set to fall.

Based on labour costs alone, U.S. and Central American textile firms are no match for their Asian rivals, although higher labour and environmental standards sought by the new pact are expected to push up costs for Vietnam.

Dan Nation, who heads the biggest U.S. yarn spinner, Parkdale Mills, says a living wage, benefits and respect for the environment were built into the cost structure of firms in the Americas, unlike in Vietnam, which the U.S. Department of Labour says is using child and forced labour.

"We have to do things they don't have to do, and we pay a lot more than 72 cents an hour," Nation says.

Home advantage

Still, the Americas have the advantage of proximity: to the consumer, increasingly important for "fast fashion" chains such as Zara, H&M and Forever 21, and to cheap, high-quality U.S. cotton.

The benefits are substantial enough to keep investment pouring into the U.S. cotton industry.

Canada's Gildan Activewear, which makes cotton wear in Honduras, Nicaragua and the Dominican Republic using U.S. yarn, is spending $340 million on U.S. spinning while Chinese textile manufacturer Keer Group plans a $218 million yarn spinning plant in South Carolina. "Apart from labour, all other manufacturing elements are cheaper in the States than in China," says Wally Wang, deputy general manager at Keer America.

Many industry insiders and experts contend the pact, which Washington hopes will reach broad agreement by November, will spark further changes in global textile and apparel trade.

China's share of the U.S. apparel market fell below 37 percent in mid-2014 from more than39 percent in 2010, while Vietnam's has grown to more than 10 percent.

"Vietnam is already less expensive than China, but then with the duty-free preference you might get a 12 percent to 32 percent duty break that's going to make a huge difference," says Julia Hughes, president of the U.S. Fashion Industry Association.

But knitwear firm Shenzhou International Group, which is planning to build fabric and garment factories in Vietnam, said in an interim report published earlier this month that unfavourable trade policies in major importing nations and rising manufacturing costs were crimping market share.

Other Chinese companies, such as fabric makers Texhong Textile Group and Pacific Textiles Holdings, also look to use Vietnam as a base.

Rules of origin will force Vietnam to replace China as the main external supplier of yarn and textiles while it develops its own industry - possibly looking at Malaysia, or maybe even the United States.

Still, many experts warn that even with such constraints, the Americas' market share may also shrink after the TPP is implemented.

"It will have an effect, and it could be a large one," says Patrick Conway, chair of economics at the University of North Carolina at Chapel Hill.