Dalian Wanda Group, China’s biggest real estate developer, is no longer interested in just being a developer. Its high-profile steps in the past six months are a convincing indicator that the conglomerate is moving elsewhere. How risky is its quasi-REITs product? How will this global juggernaut handle its transformation into an asset-light business? How will it navigate the choppy waters of Internet finance? Shangjing Li reports

Skip to

Though a bit later than promised, Dalian Wanda Group’s first online investment project finally made its debut.

In June, the company jointly launched a product called “Stable Earner No. 1” with online payment service provider 99Bill. Those who want to invest in the product can do so online or through a mobile app on their phones. Only a minimum investment of 1,000 yuan or $161 is required, which means that for the first time, investing in commercial real estate will be open to ordinary investors.

Those who signed up for the crowd-funding project can expect annualised returns of 12 percent, generated through rental fees and property appreciation.

The revolutionary move comes six months after Wanda acquired 68.7 percent of the third-party payment service provider 99Bill Corp, China’s fourth largest third-party payment company.

Many property developers in China have ramped up diversification into e-commerce and shifted away from their core business since last year in face of thinning margins and slowing sales.

Wang Jianlin, Wanda’s billionaire chairman, said in a recent staff meeting that by 2016, revenue from the company’s service sector will surpass revenue from the real estate segment. “Technically speaking, Wanda is no longer a real estate company from next year onward,” he said.

As such, it comes as no surprise that the company is making the shift to finance – Internet finance, to be exact.

Back to topREITS OR NOT?

Launching Stable Earner No.1 was widely regarded as an important step in this direction. The online investment product has raised five billion yuan or $807 million since it was introduced.

The 12 percent annualised return comprises 6 percent right to yield each year and earnings from property appreciation according to public documents acquired by ALB.

First, Stable Earner No.1 is likely to pursue listing as a real estate investment trust, which in turn would allow investors to enjoy 70 percent of the project appreciation. Meanwhile, the product can be transferred to another party. If this crowdfunding product fails to pursue an IPO within seven years, Wanda will repurchase it when it is due, which is aimed for another 6 percent of the returns.

Stable Earner No.1 was branded as a real estate investment trust (REITs) product or, to be precise, a pre-REIT or a quasi-REIT product.

“Wanda’s wealth management product is like a REIT,” Wang said in a speech in April. “If investors are in urgent need of cash and need to exit the investment, we have spoken to authorities in two financial reform trial zones to set up a title transaction platform.”

For many industry insiders, however, using the “REITs” label is only a marketing maneuver to attract buyers. The product itself inherently lies on the red line.

Alexander Li, a partner Allbright Law Offices, said the Stable Earner No. 1 is not REITs. He insists it is a kind of debt-based crowd-funding product, similar to asset-backed securities or ABS abroad. Besides, in terms of liquidity, Wanda’s product lags way behind than traditional REITs, which is tradable in public market.

Stable Earner No. 1 product does not guarantee returns of principals and gains. The proceeds will be used to finance five Wanda Plaza commercial property projects, which haven’t begun or even identified yet.

At present, China does not have specific laws regulating Wanda’s hybrid product. The most relevant law draft was released last December by the Securities Association of China. It addresses equity-based crowdfunding, indicating that fundraising should be a private placement for less than 200 real-name investors.

But Wanda’s quasi-REIT product is aimed at individuals with a mere 1,000 yuan threshold. “The product is highly likely to reach more than 200 investors. Such a move could face a sudden shut down if clear rules are rolling out,” Li said.

Lawyers have agreed that equity-based fundraising is filled with many risks. Taking this “observe first, regulate later” attitude is fundamentally risky for investors.

Wang Jianlin used to decry a lack of funding options in public. Specifically, he mentioned that China lacks REITs, which use pooled capital from investors to purchase and manage property.

Talks of introducing REITs in China started years ago, with major cities such as Shanghai and Tianjin drafting proposals in 2010 to the central bank and the State Council to seek approvals.

In June, the China Securities Regulatory Commission approved its first REIT public offering, which will consist of office properties owned by China Vanke and managed by Penghua Fund Management REITs. It is the only REITs project approved by China and will be set up in the newly established free trade zone in Qianhai, Shenzhen.

“If REITs system gets officially introduced in China’s market, it would be good news for both investors and developers. The high standard of the product will standardise our market as well. We really should call for quick introduction of REITs,” said Chen Yongxing, managing partner of Zhong Lun W&D.

Back to topTHE WANDA-FUL WAY

Wanda has been seeking to transform its bricks-and-mortar retail empire to an “asset-light” brand, looking for outside investment to finance its malls and selling them off after five or seven years.

“What is the definition of a real estate company? Besides property development, a true real estate company nowadays should be equipped with great financing power,” said Chen from Zhong Lun W&D. “Unlike real estate companies abroad, most Chinese companies face great restrictions in financing. From this perspective, Wanda’s financial innovation is very much acknowledged.”

Since last year, Wanda embarked on a series of high-profile moves. Its commercial property branch Dalian Wanda Commercial Properties raised $3.7 billion in its Hong Kong initial public offering, which made it the largest listing in Asia last year. It also strengthened its online payment platform by buying into 99bill Corp, coming up with “Stable Earner No. 1” six months later.

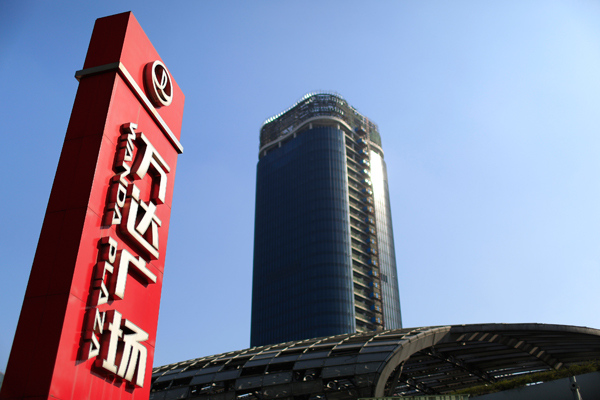

By the end of 2014, the conglomerate built more than 109 office-retail complexes called Wanda Plazas in 80 cities across China while 26 new projects are expected to open this year.

But Wanda’s chairman is eyeing a light-asset model, which means that the construction of Wanda Plazas is funded only by external investors, while Wanda takes care of site selection, project construction, merchant recruitment and property management. Using the brand appeal of Wanda Plaza and its “Huiyun” intelligent business information management system, the company is transitioning from a real estate giant to a business investment service operator.

The decision switch to the light-asset model was made after considering that the model could help diversify the property giant’s business operations and help it earn corporate revenues from rentals rather than from property sales, which is subject to great market volatility. The strategy thus guarantees a steady long-term development for the company.

“If developers want to expand aggressively, the first thing to do is to activate the asset and ensure ample cash flows. This explains why the light-asset model has become a much-wanted path for commercial developers and operators today,” said Li, a partner at Allbright Law Offices told ALB.

Moreover, early this month, Wanda has announced plans for six new acquisitions – an equal mix of foreign and domestic purchases – in the second half of 2015 to further move away from the real estate market and rebrand itself as a “service company.”

Aiming to get 65 percent of its net profit from service by 2018, Wanda said it will set up a financial holding company to “complete acquisitions of banks, security and insurance companies, and form the Wanda financial group with the existing Wanda Investment Company.”

The company is no doubt turning “Internet Plus” finance, a government-backed buzzword, encouraging the integration of offline business with e-commerce.

But is Wanda’s strategy doable or advisable for other real estate developers? Few lawyers would agree.

“Its model is not very applicable to small developers. For starters, Wanda has a brand value in selling its financial product. People know Wanda, know Wang Jianlin. Financial products from small developers would not face such a huge market demand and would be hard to sell,” said Wang Tao, a partner at East & Concord.

But whether more developers will follow in Wanda’s footsteps is not the question anymore, as moving online and towards finance has become inevitable.

“Internet finance is everywhere. And the biggest investment in our life usually goes to real estate. For developers, Internet finance lowers their cost, and for investors, Internet finance lowers the threshold for investing, thus satisfying people’s need to invest, no matter how small the amount. Therefore, Internet finance and real estate will definitely team up and be a target to pursue,” says Allbright Law Offices partner, Alexander Li.

Back to top