最近,史密夫斐尔律师事务所成为第六家在上海自由贸易区成立了联营办公室的国际律师事务所。上海自贸区中外律所联营试点于2014年启动,距今已经有五年的时间。据已经展开联营的律师们称,联营成功与否的关键在于合作双方的契合度。

今年8月,中国宣布将把上海自由贸易区的规模扩大一倍,之后将公布税收优惠和免税政策。自2013年启动以来,上海自贸区实施了一系列改革措施,以吸引更多的国际商业兴趣,而最近的这些发展可能将会带来更多的增长。

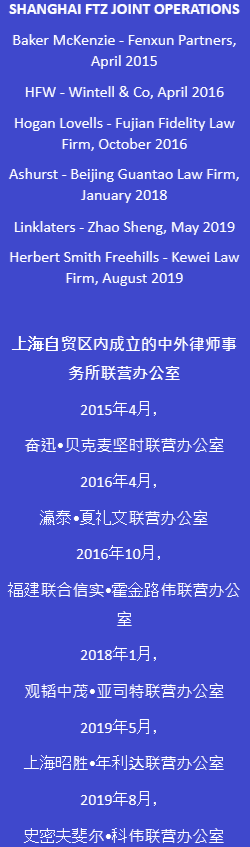

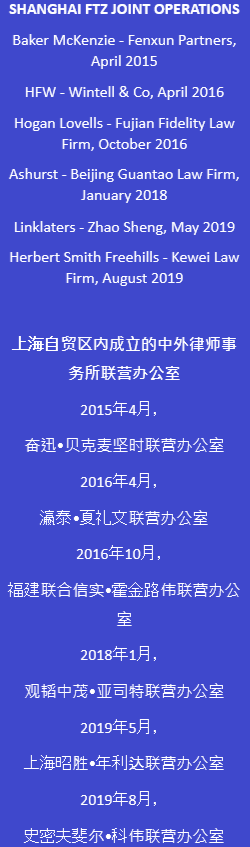

因此,上海自贸区引起国际律师事务所的兴趣也就不足为奇了。目前,已经有六家外国律师事务所通过成立联营办公室在上海自贸区开展业务;其中最近的一家是史密夫斐尔律师事务所。史密夫斐尔律师事务所的总部设在英国的伦敦和澳大利亚的悉尼。今年8月,史密夫斐尔宣布将与上海科伟律师事务所在上海自贸区成立联营办公室。科伟律师事务所是一家精品律师事务所,由合伙人许文宝于1995年创立。

史密夫斐尔律师事务所大中华区管理合伙人戴枫媚女士表示,虽然最近才公布了联营的消息,但双方的合作关系已经酝酿了很长时间。科伟的两位合伙人郭武汉先生和谢守德先生都曾在史密夫斐尔任职多年——郭律师于2006年至2014年期间担任该所上海办事处的合伙人,而谢律师几乎整个执业生涯都是在史密夫斐尔度过的,直至今年7月才以国际合伙人的身份加入科伟。

“所有在中国有重要业务的国际律师事务所都在考虑如何在中国发展和扩大他们的业务,当然前提是符合市场的开放程度和中国企业的增长,”戴律师说。“大约五年前,这一机遇出现了,上海自贸区放宽了相关规定,允许国际律师事务所与中国律师事务所以一种以往不允许的方式开展联合经营。”

戴律师表示,在确定与科伟的联营安排之前,史密夫斐尔与一些精品所和大型红圈律所都有过接洽。她说最终促成这一决定的是两家律所之间有许多相似之处且拥有良好的关系。“双方都做了大量的尽职调查,花了很多时间相互了解,并且能够顺畅地一起工作,然后我们放心地向有关部门申请审批。”

为客户带来的好处

戴律师进一步指出,史密夫斐尔选择了一家规模相对较小的律所,这样两家所就能够共同成长和发展。“ 我们的目标是建立一家能够为中国客户和在中国投资的外国客户提供 物有所值的服务——他们将能够得到由一家提供全方位、全覆盖服务的综合性顶级律师事务所提供的服务。”

这一观点得到了贝克麦坚时律师事务所的赞同。贝克麦坚时于2015年率先与奋迅律师事务所在上海自贸区成立了奋迅•贝克麦坚时联营办公室——上海自贸区第一家中外律所联营办公室。与史密夫斐尔一样,贝克麦坚时的合作关系依赖于强大的文化契合度和实务上的协同。“奋迅律师事务所的国际化理念及建立更有力的平台的目标与贝克麦坚时的合作和友谊文化非常吻合。作为一个联合平台,我们在满足贝克麦坚时在中国投资的客户以及奋迅•贝克麦坚时在海外投资的客户的需求方面实现了无缝协同。” 贝克麦坚时亚洲管理合伙人Milton Cheng说。

Cheng律师表示,通过其上海自贸区联营办公室,贝克麦坚时现在能够“为其客户无缝地处理国际和跨境方面的问题以及中国境内的法律问题”。他特别提到,他们现在还能代表客户向商务部、国家外汇管理局等监管机构提出申诉,以及代表客户在中国法院出庭。

“通过我们的联营平台,我们能够在全中国范围内为客户提供全方位、综合性的法律咨询服务,包括中国的争议解决、有争议的税收、合规、知识产权、房地产和就业等,以及交易服务,尤其是在并购/私募股权、银行和金融以及项目融资等客户需求强劲的领域,这些是其他大多数国际律所目前无法企及的优势,”他补充道。

戴律师本人是仲裁律师,因此在解决跨境争议方面非常强调律所的能力。

“许多争议不是通过一种体制就能解决的,而是需要多个平行的仲裁和诉讼程序。举例来说,如果我在香港有一个跨境仲裁,我们可能需要在内地寻求临时救济以冻结资产,或最终在内地执行仲裁裁决。”

“在这两个方面,国际律所无法为其客户提供帮助,因为他们无法代表客户在内地法院出庭,所以过去我们通过不同的中国律师事务所来协助这方面的工作;但今后我们将有能力通过史密夫斐尔和科伟的协作为客户提供一站式服务,”戴律师表示。

The Right Fit

Herbert Smith Freehills recently became the sixth international law firm to enter into a joint operation (JO) in the Shanghai Free Trade Zone, about five years after China first allowed these alliances. Lawyers who have entered into JOs say that to make these relationships work, it’s vital that the two firms are compatible with each other.

Herbert Smith Freehills recently became the sixth international law firm to enter into a joint operation (JO) in the Shanghai Free Trade Zone, about five years after China first allowed these alliances. Lawyers who have entered into JOs say that to make these relationships work, it’s vital that the two firms are compatible with each other.

In August, China announced it was to double the size of the Shanghai Free Trade Zone (FTZ), with tax incentives and exemptions being revealed after. Since it was launched in 2013, Shanghai’s FTZ has undergone a raft of changes to attract greater international business interest, and these recent developments indicate more growth may be on the horizon.

It’s no surprise, then, that it has attracted the interest of international law firms as well. Currently, there are six foreign law firms operating in the FTZ under joint operation (JO), with the most recent one being Anglo-Australian firm Herbert Smith Freehills. In August, HSF announced it was launching a JO in the FTZ with Shanghai Kewei Law Firm, a boutique outfit launched by partner Xu Wenbao in 1995.

May Tai, Greater China managing partner at Herbert Smith Freehills, says that while this may have just been announced, the relationship has been a long time in the making. Two of Kewei’s partners - Gavin Guo and Stanley Xie – have spent a significant amount of time at HSF. Guo was an associate at the firm’s Shanghai office between 2006 and 2014, while Xie has spent the entirety of his career – beginning in 2007 – at HSF, only moving to Kewei as an international partner in July this year.

“All international law firms with a significant presence in China have been considering how to develop and expand their offerings in China, in line with the opening of the market and the growth of Chinese companies,” Tai says. “About five years ago, the opportunity came in the form of the relaxation of the regulations in the Shanghai FTZ, which allows an international law firm and a Chinese law firm to combine their offerings in a way that hasn’t been permitted previously.”

Tai says that HSF initially met with a mix of niche boutiques and large Red Circle firms before settling on the Kewei arrangement. She says that eventually what drove the decision was the compatibility and the good relationship between the two firms. “It took a long time to get to a place where both firms had done lots of due diligence, knew each other and were comfortable working together,” she adds. “Then were comfortable putting a forward and application to the authorities for approval.”

BENEFITS FOR CLIENTS

Tai further notes that HSF chose a relatively small firm so that the two operations could grow and develop together. “The objective is to have a law firm that can service China in the way that Chinese clients and foreign clients investing in China deserve to be served, by a top tier law firm that is full-service, full-coverage.”

It is a view echoed by the FTZ JO pioneer, Baker McKenzie, which launched its tie-up with FenXun Partners back in 2015. And much like HSF, the firm’s partnership relies on a strong cultural fit and practice synergies. “The FenXun Partners’ international mindset and vision for a stronger platform fit well with the Baker McKenzie culture of collaboration and friendship. As a combined platform, we have achieved seamless synergies in servicing the needs of Baker McKenzie’s clients investing into China and of Baker McKenzie and FenXun’s clients investing overseas,” says Milton Cheng, the U.S. firm’s Asia managing partner.

Cheng says following the FTZ joint operation regime, the firm has been able to “handle seamlessly both the international and cross-border aspects for our clients as well as the onshore Chinese law aspects”. It has also represented clients before regulators, including the Ministry of Commerce and the State Administration of Foreign Exchange, as well as in Chinese courts, Cheng notes.

“Through our joint operation platform, we are able to advise clients on their legal needs across China on a full-service basis, including PRC dispute resolution, contentious tax, compliance, IP, real estate and employment, which most other international firms currently cannot match, as well as transactional services particularly in M&A/private equity, banking and finance, and project finance, where there is strong client demand,” he adds.

Tai, herself an arbitration lawyer, emphasizeds the capabilities when it comes to cross-border disputes.

"Today you are not resolved in one forum alone and there with be multiple parallel arbitration and litigation proceedings. To give you an example, if I have a cross-border arbitration that is seated in Hong Kong on occasion we may need to seek interim relief In the mainland to freeze assets, or ultimately to enforce the arbitral award in the mainland."

"Those are two aspects that an international firm couldn't help clients with because they can't appear in the mainland courts, so in the past we used different Chinese law firms to assist with that aspect, going forward we now have the ability to Provide a one-stop-shop offering between HSF and Kewei,” she says.

To contact the editorial team, please email ALBEditor@thomsonreuters.com .